The 2024 crop year in the Corn Belt can be described as uneven. Early corn and soybean prices provided some positive marketing opportunities, but both commodities saw prices drop 16% and 30%, respectively, throughout the crop year.

Crop yields performed better than anticipated. The growing season began with excess moisture challenging planting, followed by dry weather in late summer. This caused many growers and agriculture investment companies to anticipate lower yields, specifically for soybeans. However, crop yields were resilient.

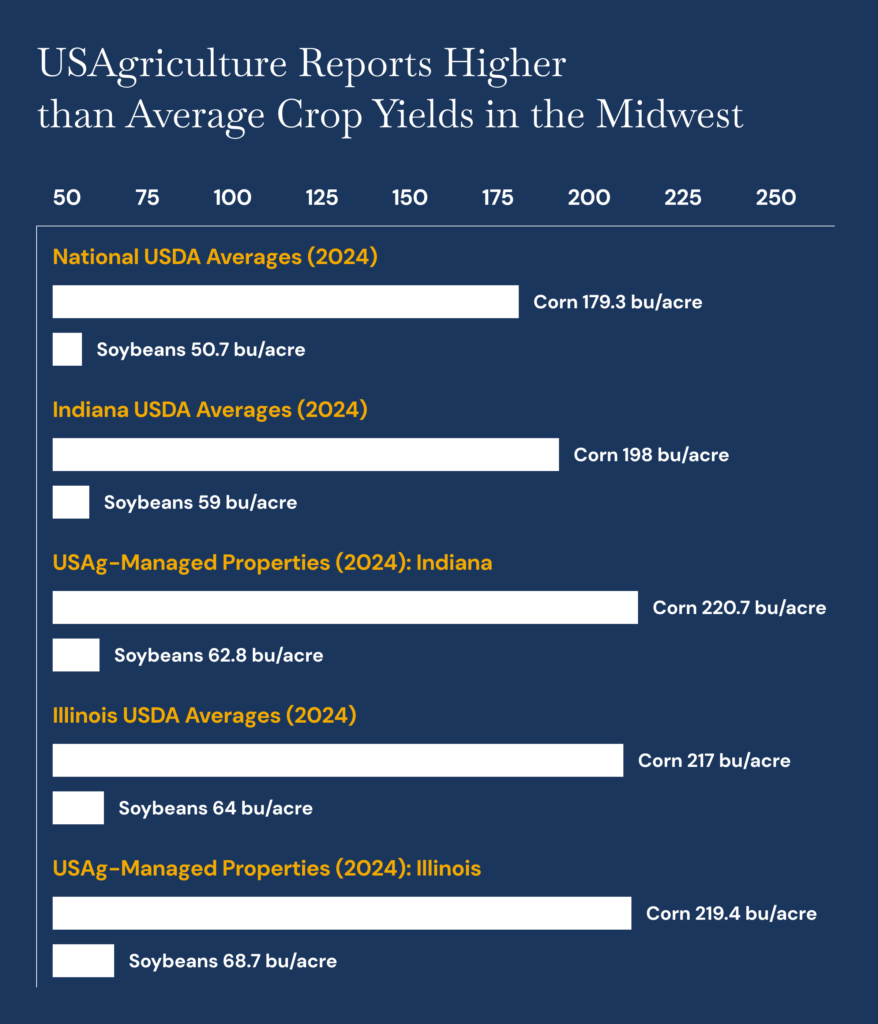

Corn & Soybean National Average Yield per Acre in 2024

During harvest, growers consistently reported near or above record corn yields, while describing soybean yields as average or slightly above average. Yield data from the 2024 USDA Crop Report supported this narrative. The final national corn yield was a record 179.3 bushels per acre, and soybean yields finished at 50.7 bushels per acre, just over the USDA 10-year average yield of 50.08 bushels per acre.

Regional Spotlight: Indiana and Illinois Yield Data

US Agriculture, LLC’s (“USAg”) managed Corn Belt properties reside in Indiana and Illinois. According to the USDA, Indiana’s 2024 corn and soybean yields were 198 and 59 bushels per acre, respectively, while Illinois were 217 and 64 bushels per acre, respectively.

For Indiana, the USDA corn yield was the second-highest on record, while the soybean yield was approximately 3 bushels per acre above the 10-year average.

In Illinois, the 2024 corn yield was a record, according to USDA data, while the soybean yield was approximately 3.5 bushels per acre above the 10-year average.

USAg’s Managed Properties Surpass Regional Averages

USAg’s tenants generally reported strong yields on USAg-managed properties.

In Indiana, USAg-managed properties averaged 220.7 bushels per acre of corn, and 62.8 bushels per acre of soybeans.

Similarly, USAg-managed properties in Illinois averaged 219.4 bushels per acre of corn, and 68.7 bushels per acre of soybeans.

USAg takes considerable interest in improving farms after acquisition to help bolster productivity as part of our agricultural investment management strategy. This includes finding the best farmer for each property and making financial investments to improve farms.

Through these efforts, USAg seeks to increase the productivity of the tillable ground. As a farmland investment firm, USAg takes pride in its properties producing above-average yields during the 2024 crop year.

Outlook for 2025

As we turn the calendar to 2025, land values have been resilient. Like other agriculture investment companies, USAg receives multiple appraisals on each property annually.

These third-party reports have suggested Indiana and Illinois properties have declined by an average of approximately 2% during 2024 despite far more dramatic price declines in corn and soybean prices experienced during the year.

As a farmland investment firm, USAg expects highly productive farms to hold their value relative to less productive farms. Farmland investment companies, in general, will need to keep a keen eye on these values throughout the year, as the Corn Belt remains a crucial part of American agriculture.