Trade Policy and Farmland Investment in 2025

Trade policy continues to dominate economic discussions, especially in sectors tied to global markets. For U.S. farmland investment companies and the agricultural industry, international trade policy plays a critical role in shaping market dynamics, commodity prices, and long-term investment strategies.

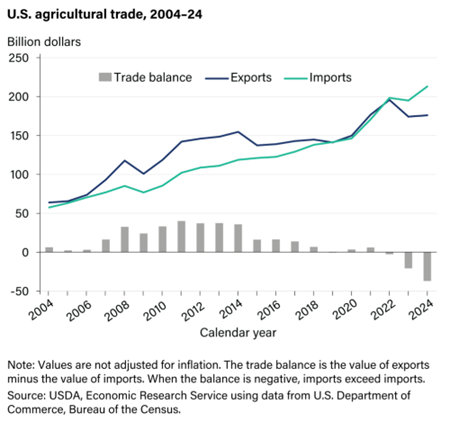

While recent policy changes have created short-term volatility, broader agricultural trade trends have been shifting over the last 5 to 10 years. Historically, the U.S. maintained a strong agricultural trade surplus – as seen in the chart below – but that changed in 2019 when the country recorded its first agriculture trade deficit in nearly 60 years.

Although the COVID-19 pandemic temporarily reversed this trend, the trade deficit in agriculture persisted into 2023. According to the USDA Economic Research Service (USDA-ERS), the shift is driven by slowing export demand and rising agricultural imports.

Why Is the U.S. Agricultural Trade Balance Changing?

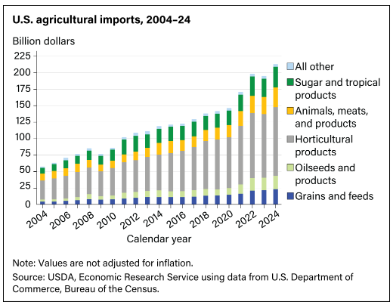

The USDA-ERS attributes the decline in agricultural exports to a strong U.S. dollar, increased global competition, and new trade barriers and tariffs. On the import side, a strong domestic economy has boosted demand for high-value agricultural products, such as:

- Fresh fruits and vegetables

- Off-season produce

- Alcoholic beverages

- Tropical and horticultural goods

These products are either unavailable domestically or are imported due to quality and seasonality advantages. USDA data in the chart below shows a consistent increase in imports of horticultural and tropical products, supporting this trend.

How Farmland Investment Firms Manage Trade Risk

For companies like US Agriculture, LLC, risks associated with shifting trade dynamics can be mitigated through diversified farmland investment portfolios. Diversification by crop type, geographic location, and end-user market can help hedge against volatility driven by trade policy changes.

Export-Heavy Commodities at Greater Risk

Certain U.S. crops—particularly oilseeds and food grains—are highly reliant on export markets, making their prices sensitive to tariff changes and trade restrictions.

In contrast, dairy products are mostly consumed domestically, with only around 18% exported. While tariffs may impact milk prices, the effect is likely to be smaller than for more export-dependent commodities. Moreover, if grain prices fall due to reduced export demand, dairy farmers should benefit from lower feed costs, helping stabilize incomes and land values in dairy-centric farmland regions.

Innovation and Specialty Crops

Research and development that leads to innovation can also help to mitigate the effect of changes in trade policy. In the specialty crop sector, particularly fresh fruit, research into new varieties can open new marketing windows, increase yields, and/or enhance product quality, all of which help to overcome the effect of tariffs by offering a differentiated product.

Crops like table grapes and blueberries are prime examples, as recent innovations in these crops have extended growing seasons, improved yields, and helped U.S. growers access unique export windows. Agricultural investment companies that capitalize on these developments are better positioned to adapt to changing trade environments.

Building Resilient Farmland Portfolios Amid Trade Policy Shifts

The U.S. is one the largest and most productive agricultural producers in the world. Naturally, as a critical supplier to the world, it will continue to have exposure to evolving global trade policy.

However, by focusing on portfolio diversification, monitoring commodity-specific trade dependencies, and leveraging crop innovation, U.S. farmland investment managers can better navigate both short- and long-term challenges.

At USAgriculture, we remain committed to a diversified portfolio approach that helps mitigate the risks of agricultural trade disruptions, ensuring resilience and stable returns for investors.