Trade policy changes create short-term uncertainty and have the potential to alter existing trading relationships and trade flows. In isolation, these changes may appear to only result in higher logistical costs and greater inefficiencies. Even so, in the long term, the limited and essential nature of agricultural production ensures demand will be strong.

Current Tariff Situation and Immediate Effects

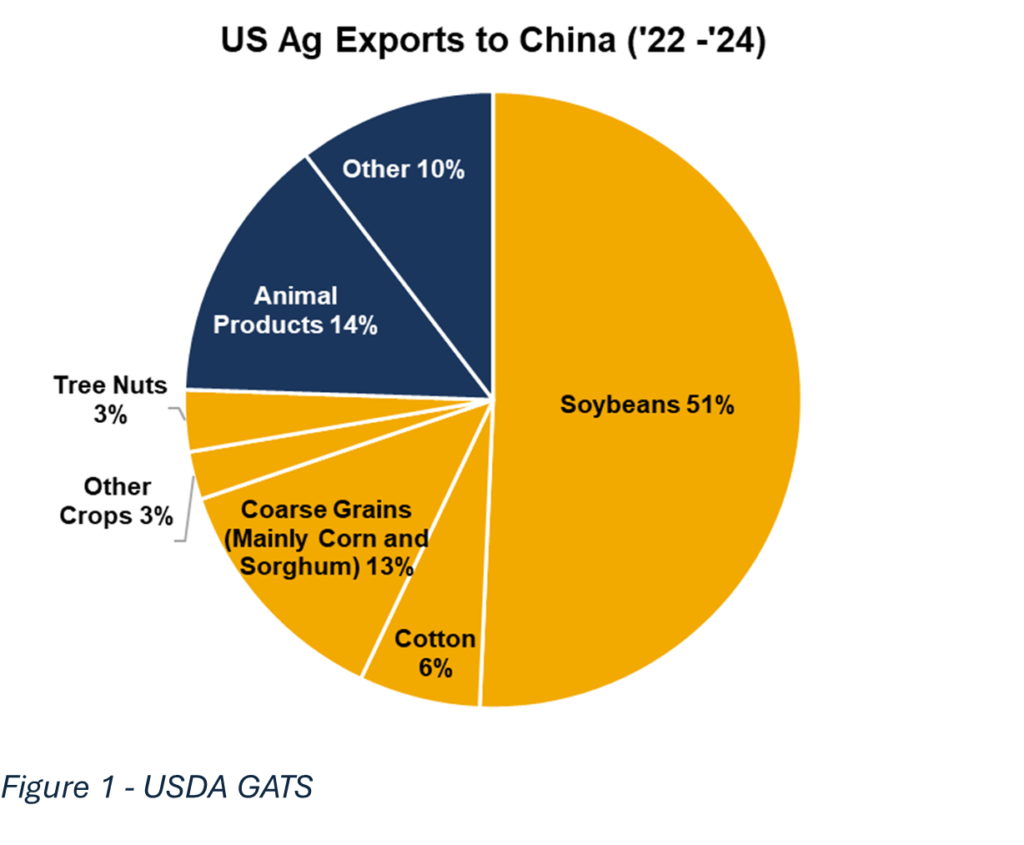

China, Canada, and Mexico – the top three export markets for U.S. agricultural products – have been the target of tariff threats over the past few months. The situation continues to evolve, but as of April 2nd, 2025, tariffs against Canada and Mexico have largely been postponed, due to the United States – Canada – Mexico Agreement (“USMCA”) compliance exceptions1. Important inputs for agriculture, namely potash and oil, fall under the USMCA exceptions. As for China, its US-levied tariff rate jumped 10% in February, 20% in March, and 34% in April, bringing its cumulative tariff rate to 76%2. China responded with retaliatory tariffs, levying a 34% tariff in April, increasing its average tariff rate on U.S. goods to approximately 50%3. As shown in Figure 1, U.S. soybean producers are likely to be the most affected by retaliatory tariffs levied by China. In general, the tariffs proposed by the current administration create uncertainty, and the extent to which other countries implement reciprocal tariffs will be a key variable for profitability for many U.S. farmers in 2025.

Varying Impacts Across Agricultural Sectors

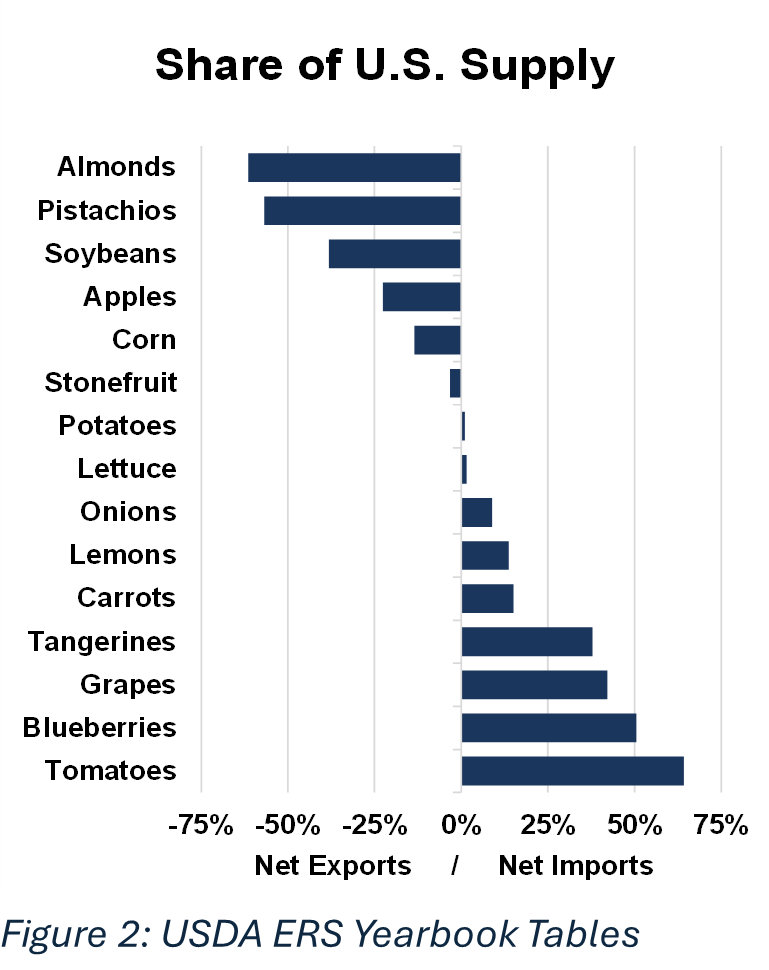

When governing and negotiating on behalf of a country with such a large and diverse group of stakeholders, policy changes will be perceived as detrimental by some and as favorable by others. Agriculture as a whole is likely to benefit from certain policies and be negatively affected by others, resulting in varying outcomes among its stakeholders. For example, Figure 2 illustrates the relative importance of imports and exports for specific crops in relation to supply. Crops produced in the U.S. that are heavily exported (e.g., almonds, pistachios, and soybeans) are likely to be negatively affected by tariffs, while crops that compete with imports from other countries (e.g., tomatoes, blueberries, and grapes) are likely to benefit.

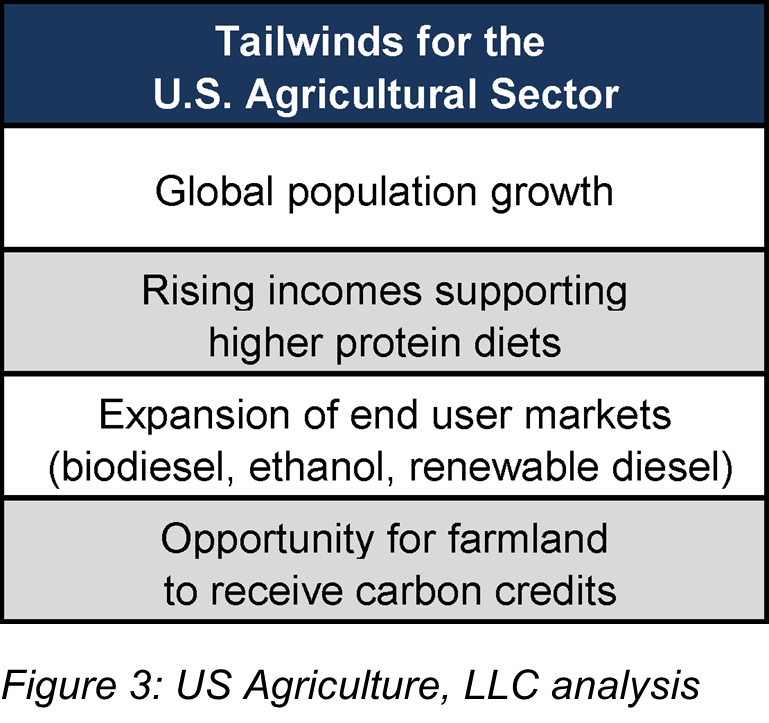

Long-Term Stability and Investment in Farmland

Farmland and USAgriculture’s investment approach are powerful tools for mitigating uncertainty. Farmland is a finite, tangible resource that produces daily essentials, needed in both good and bad economic times. One certainty is that as human populations grow and develop, the demand for agricultural production will increase. Increased demand for limited resources generally leads to increased asset values. These realities are a cornerstone of the investment thesis for farmland, and they help explain why farmland produces relatively stable investment returns and strong diversification benefits.

- https://www.whitehouse.gov/fact-sheets/2025/04/fact-sheet-president-donald-j-trump-declares-national-emergency-to-increase-our-competitive-edge-protect-our-sovereignty-and-strengthen-our-national-and-economic-security/ ↩︎

- https://www.piie.com/research/piie-charts/2019/us-china-trade-war-tariffs-date-chart ↩︎

- Ibid. ↩︎